Lorena Arechiga-Playo was eager to join a matched savings program when she found one being offered through East Bay Asian Local Development Corporation (EBALDC) in Oakland,  California. She knew such a program, where a lender or nonprofit pledges to match a certain amount of what a client puts into savings, would increase her savings efforts.

California. She knew such a program, where a lender or nonprofit pledges to match a certain amount of what a client puts into savings, would increase her savings efforts.

It just takes one step to start changing your finances, she says. Arechiga-Playo started by setting up an auto transfer from her checking account to her savings account for $1 a day. "It may not seem like a lot, but little by little, it adds up," she explains. "Even if I didn't save any additional funds in the month, I at least saved a minimum of $30 dollars."

As her finances improved, she transferred $5 a day. Today, a graduate of the program, she saves about 10% of her income. Some of her savings went to paying off debt and the down payment of her home. Both are essential steps in the homebuying process.

10% of her income. Some of her savings went to paying off debt and the down payment of her home. Both are essential steps in the homebuying process.

Arechiga-Playo says she has always been good at saving, but being in the program and meeting monthly with a financial coach gave her a different perspective and taught her to be more disciplined. "I have kept my habit of saving,"she says.

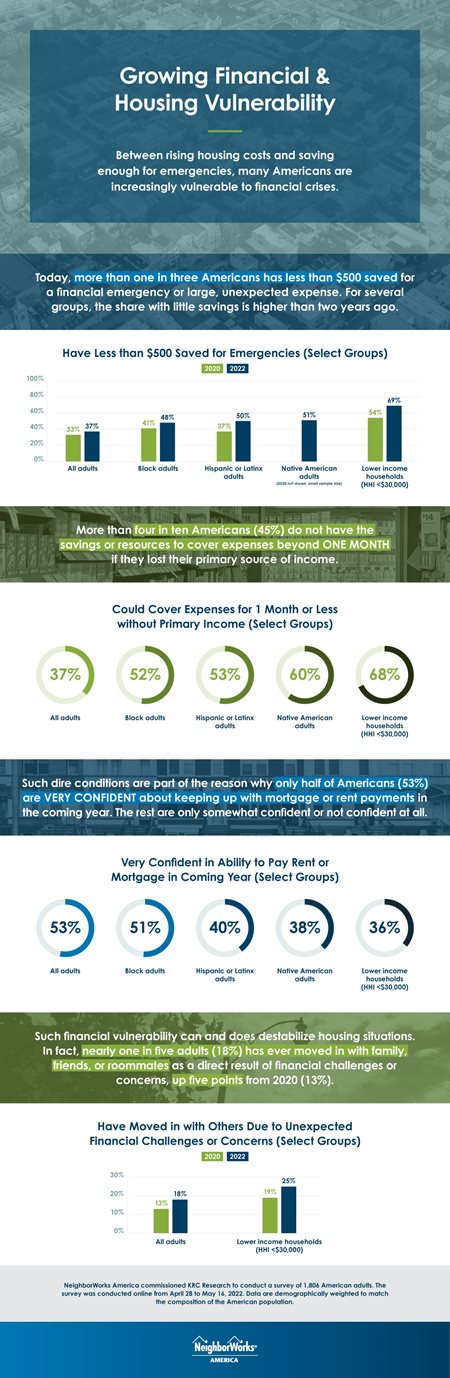

This month, NeighborWorks America released its annual Housing and Financial Capability Survey, which found most Americans are doing all they can to ensure financial security. Forty-six percent of American adults say paying everyday expenses is their top financial goal, with 23% saying saving for future expenses is their top goal.

Meanwhile, only two in three Americans have any money saved for a financial emergency, though there have been some increases in the last two years in the share of those with emergency savings who have $500 or more, especially among white and Black Americans. Over a quarter of Americans said their savings would run out within a month were they to lose their primary source of income. Black, Hispanic or Latinx, and American Indian and Alaska Native households are at even greater risk.

Lee Anne Adams, NeighborWorks America's Senior Vice President of National Initiatives, says the survey helps us understand "who needs our help and what help is needed."Identifying those areas can lead, in turn, to problem solving. Matched savings, and the counseling that goes with such programs, for instance, is a way to help people start a new habit of saving for what they want and need, and also for the unexpected.

"These programs serve as motivators,"explains Molly Barackman-Eder, director of Financial Capability at NeighborWorks America. Over the past five years, NeighborWorks America has explored, researched and supported matched savings.

"Matched savings can be the boost that helps people achieve their financial goals and sustain financial well-being,"Barackman-Eder says. "Programs like this help people build a savings habit that serves their long-term financial health – even when the formal program ends.”

NeighborWorks research shows that after entering a matched savings program, low-income households started building savings for emergencies and more. Matched savings programs with NeighborWorks network organizations often link clients to other services, including financial coaching, which can be a program requirement.

EBALDC has been implementing matched savings programs for 25 years and was one of the first Individual Development Accounts (IDA) during the federal government's foray into matched savings. The organization continues to host similar programs. "If someone takes the time to look at their finances, work, be accountable and save gradually, it can start a pattern of looking at finances differently, of looking at savings differently,"explains Elizabeth Maggio says, EBALDC's associate director of Economic Opportunties

About 90% of EBALDC's participants have success in completing matched savings programs, Maggio says. Even during the pandemic, when countless people had emergencies, clients kept saving, she says. Financial coaches help with the accountability piece. "Any time you make a change – with money or exercise or diet – having a partner makes a huge difference. It's wonderful to be able to have an incentive. And you get a nice congratulations when you're done.”

NeighborWorks America's ' Housing and Financial Capability Survey also shows Americans are interested in guidance and help when it comes to achieving their financial goals, with more than half saying they'd be interested in taking financial planning classes to improve their situation. As Maggio says, "It's easier with a partner.”

07/20/2022