In mid-July, NeighborWorks America released its 2022 Housing and Financial Capability Survey confirming, as it has in previous years, the overwhelming desire of Americans to own their own homes. That includes Native Americans, oversampled as part of this year's survey so that NeighborWorks can be more informed about this population's needs and how to work in partnership with them. In South Dakota, NeighborWorks network organizations have already been hard at work, identifying and removing barriers to homeownership and financial wellness for Native Americans.

NeighborWorks can be more informed about this population's needs and how to work in partnership with them. In South Dakota, NeighborWorks network organizations have already been hard at work, identifying and removing barriers to homeownership and financial wellness for Native Americans.

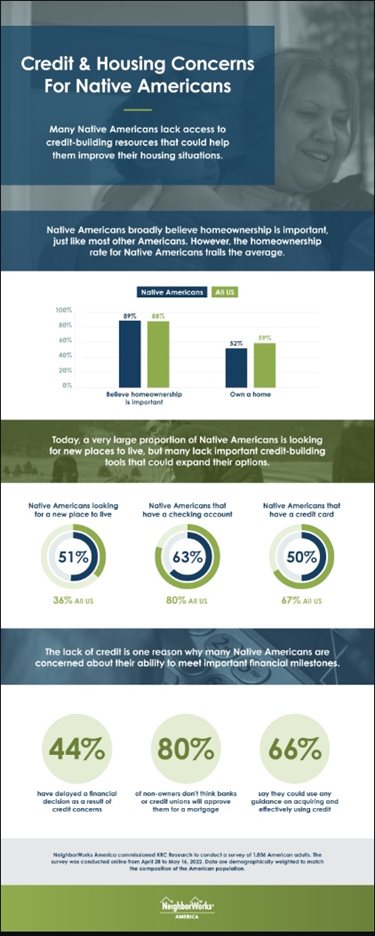

The survey shows that just over half of Native Americans – 52% – own homes, compared to 59% of Americans overall. Tawney Brunsch, executive director of Lakota Funds, says the homeownership gap in South Dakota is broader, with census data showing that 38% of Native Americans own homes in her state. Her organization became a part of the South Dakota Native Homeownership Coalition to identify possible solutions. They are not alone.

"As a coalition, we've been building solutions since 2013, to answer the question, 'What are the barriers of homeownership among Native American communities?'" shares Lori Moen, Chief Operating Officer of GROW South Dakota, also a coalition member. The coalition examines issues like limited housing stock, homebuyer readiness, and helping Native families see homeownership as a viable option.

It works like a learning lab, shares Mellor Willie, NeighborWorks America's new director of Native Strategy, who attended a coalition meeting this summer. Participants bring forward challenges and test out solutions through pilot programs finding what will work and what can be replicated. "They've done really well with their pilot projects, finding workable solutions," Willie says. "They have open, trustful conversations." That allows the group to identify problems and fill gaps.

"When 80% of the Native population does not believe they can get a mortgage, then we have to ask ourselves: What we are doing and is it the right strategy?" shares Willie. "At NeighborWorks we believe the best solutions comes from within — and that's from the tribes. Right now we are partnering with national Native organizations to provide wide-scale financial education to Native families, and helping tribal communities to address the lack of homeownership."

Moen works on the policy committee, looking at policies that might hinder homeownership for Native communities. She notes recent changes, including an adaptation allowing the USDA to lend 502 direct capital to Native community development financial institutions (CDFIs), which can be re-lent to qualified Native homebuyers. The program started as a coalition pilot with two Native CDFIs and is on its way to becoming public policy.

"In two years, through this public-private partnership, the Native CDFIs deployed almost twice as much capital than the USDA did in the previous 10 years," adds Brunsch. "That's what kind of demand we have." Another policy, the Native American Direct Loan Improvement Act, would reform the U.S. Department of Veteran Affairs' Native American Direct Loan Program for Native American veterans living on trust land. "We've been lifting this up for five years now," Brunsch says. The reform effort would ecourage the VA to engage local entitites to prepare Native American veterans for homeownership and would utilize the same relending model piloted by the USDA.

The coalition is also working to increase the number of home inspectors and appraisers in tribal communities. Finding contractors to build the homes is an issue, too, so the coalition began an internship program to help create a more experienced workforce.

Meanwhile, the number of Native families coalition members have helped obtain homeownership has doubled in recent years. A 2021 snapshot from the coalition shows 85 home-related loans closed and packaged, with 48 new Native homeowners. Of those, 11% live off the reservation, with 89% on or near reservations. More than half of the loans came through Native CDFIs. The snapshot shows at least additional 160 families in the loan pipeline for homeownership.

As the pipeline of home-ready residents increases, other issues surface – the need for more housing inventory, for instance, and the need to build a secondary market for loans. The coalition tackles those issues, too.

"We must remember that we are not going to reverse hundreds of years of inequality overnight," Willie says. "That's not going to happen. However, we know that working with tribes we can help rebuild the social fabric of tribal economies in exciting and dynamic ways. This work is inspiring."