The winter holidays and the start of school are times when expenses can suddenly spike. Many low- to moderate-income families are unable to cover them, turning instead to expensive, predatory payday, auto-title or similar loans. Clearly, a safe alternative is needed.

“On average, we found that our clients had one, two or even three payday or auto-title loans of some kind. Some even had up to six or seven,” says Jeremy Stremler, an associate for resource development and strategic planning for the Community Development Corp. of Brownsville, Texas. “At CDC of Brownsville, we're really focused on keeping people from falling into a chronic cycle of poverty. One of the biggest challenges the working poor face is when a sudden need arises, like when their car breaks down and they can’t afford to get it fixed so they can go back to work. Then they get fired and fall into a downward spiral. We set out to provide a service to stop that cycle.”

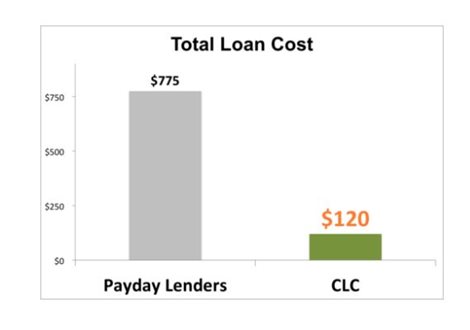

In most cases, these families don’t have the credit history required to borrow from a reputable bank. So, they turn to payday and similar loans. In Texas, notes Stremler, the standard, $1,000 payday loan must be paid back (plus $200-$400 in fees) in 14 days—typically not long enough for a family to scrape up the funds. That typically means extending it again and again, and by the time they satisfy their obligations, “they have paid the equivalent of 600 percent interest because of the fee they had to pay each time.”

A new guide to small loans prepared by NeighborWorks America for coaches to use with their clients offers the following advice:

If your credit score is good enough (670 points or higher), you may be eligible for a personal loan from a bank, credit union or online lender at a reasonable cost. If you don't know how to find such a loan, or your credit score is low, a properly trained counselor can help you avoid high-cost loans, triggering a cycle of borrowing that is difficult to escape. When looking for the best loan options, your counselor will help you:

• Avoid paying penalties (such as late fees or additional interest) by finding a loan that allows repayment over time according to an affordable schedule, rather than in one, lump sum.

• Find alternatives to "payday loans.” They are easy to obtain because you don’t have to pass a credit check, but the cost is so much higher than the amount you borrow.

• Improve your ability to obtain larger loans at less cost by first taking out smaller ones. These smaller loans are reported to credit bureaus so you strengthen your "financial reputation."

• Obtain clear information about the full cost of a loan, as well as the risks (for example, the consequences of nonpayment and whether employment must be verified).

Employer-partnership model

One type of solution offer by NeighborWorks members is the model first developed by the CDC of Brownsville, which serves the Rio Grande Valley—one of the poorest yet fastest-growing regions in the country. In 1995, the CDC established the Rio Grande Valley Multibank (RGVMB) to provide alternative financing for affordable housing in the region. As an extension of its work, the multibank launched its Community Loan Center to provide an easy-to-pay-off option for residents needing small, irregular infusions of cash. The program, which since has been franchised to 20 financial institutions in Texas, Indiana, Maryland, North Carolina, South Carolina, Tennessee and Missouri, works through partnerships with local employers. A maximum of $1,000 is loaned per person, with a set-up fee of $20 and a payback period of 12 months. The interest rate is 18 percent. Monthly payments are set at an affordable level and are deducted from their paychecks. No credit history or collateral is required, there are no prepayment penalties and free financial counseling comes with the loan. Since 2011, the center has distributed 41,272 loans totaling more than $43 million.

The program, which since has been franchised to 20 financial institutions in Texas, Indiana, Maryland, North Carolina, South Carolina, Tennessee and Missouri, works through partnerships with local employers. A maximum of $1,000 is loaned per person, with a set-up fee of $20 and a payback period of 12 months. The interest rate is 18 percent. Monthly payments are set at an affordable level and are deducted from their paychecks. No credit history or collateral is required, there are no prepayment penalties and free financial counseling comes with the loan. Since 2011, the center has distributed 41,272 loans totaling more than $43 million.This leaves out, of course, residents who do not work for a participating employer or do not receive regular paychecks. (Participants also must have a checking account and a driver’s license/passport and social security number.)

“Unfortunately, if we opened the program up to those without regular salaries, our fees it would have to be much higher,” explains Stremler. “That's why payday-loan companies charge $300 and up; if you walk out and never come back to re-pay, then they still get part of their money back. By restricting our loans to those with reliable employers, we’ve kept our default rate to under the industry standard of 5 percent. It’s more like 2-3 percent.”

Cathy Semans, director of lending for NHS of Baltimore, one of the franchisees of the RGVMB model, agrees. Her organization had previously tried making small loans without an employer link and the default rate was too high. Today, in addition to the employer-based loans, NHS of Baltimore also makes small loans for home rehab using foundation grants and works with partner organizations to provide others. For example, it provides small loans to new immigrants, who have proven to be very low risk in previous experiments, through the International Rescue Committee and to (through a partnership now being finalized with Vehicles for Change) individuals needing to make car repairs.

Stremler says he hopes the RGVMB model will be franchised in all 50 states “in the not-too-distant” future.” His organization services all the loans, but looks to the local nonprofits to identify and recruit employers.

“Local organizations will know which employers have employees who are consistent and long term,” he notes. “In addition, while we have capital to help franchisees get started, it is the franchisee's responsibility to go out and raise money to lend to individuals in their community.”

For example, Stremler notes, signing up employees who work for the port authority in Brownsville turned out to be a problem because so many work for just a few months on ship breaking (demolition), then get laid off. And then when a new ship comes in, they are hired back again. That type of cyclical work doesn’t work with this model for small loans.

“The way to be successful in this line of service is to really know your community—where you can do the most good on the largest scale,” says Stremler. That's the main reason we franchise the model; we're not going to try to pretend like we can know each market.”