Economic hardships are changing the way we live, according to a new NeighborWorks America survey released on July 16. The survey, conducted annually, examines Americans' feelings and behaviors when it comes to housing and personal finances.

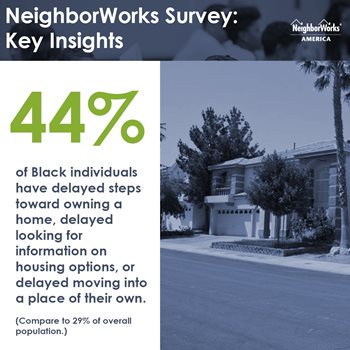

The survey was conducted in May, amid concerns about COVID-19 and the layoffs and housing instability that followed. The results show that while two in three Americans feel prepared for financial challenges, one in 10 have moved in with others to make ends meet, and three in 10 have delayed progress toward homeownership. Forty-four percent of Black individuals delayed steps toward owning a home, the survey found, compared with 29% of the overall population. The survey also found that only 40% of Blacks owned homes, a decrease of 8% since last year's survey. But the survey also showed that people are hungry for resources that can help them, including classes or coaching from nonprofit organizations.

"Navigating the financial landscape in this country can be confusing and tricky," said Karen Hoskins, NeighborWorks America's vice president for National Homeownership Programs and Lending, responding to data that seven in 10 individuals found the homebuying process to be complicated. "Many Americans could benefit from the financial guidance and coaching that is available through HUD-approved counseling agencies. These non-profit organizations' mission is to be of support in helping consumers improve the quality of their lives and often that begins with getting your finances in order. Financial success is determined in large part by how well you manage money and credit. The sooner you develop those skills, the brighter your financial future will be."

Hoskins said that homeownership can be easier to obtain than many people think. The first step for prospective homebuyers, according to Hoskins, should be to connect with a housing counseling agency approved by the U.S. Department of Housing and Urban Development, or HUD. "HUD agencies help consumers understand the process, and they will conduct a financial review to determine your readiness to buy a home," she said. "And even if you're not, they can help you design a plan to prepare."

NeighborWorks America has more than 240 organizations across the country that can help, she added. "The information and guidance they provide will help you make informed decisions about which home to buy and what mortgage options are available to make it more affordable."

NeighborWorks America has more than 240 organizations across the country that can help, she added. "The information and guidance they provide will help you make informed decisions about which home to buy and what mortgage options are available to make it more affordable."

Says Susan M. Ifill, NeighborWorks' executive vice president and chief operating officer, "No one has to go it alone."

Ifill, on a media tour in conjunction with the release of the survey, said during one of the recent interviews that the situation is more acute for individuals with low to moderate incomes. "As I like to say, when America gets a cold, this group of people gets pneumonia, and now you have COVID. As the numbers will show you, it is dire."

The survey also addressed feelings about finances and found that immediate financial concerns often took precedence over saving for the future.

"The survey underscores the long-lasting impact of financial emergencies like the one we're seeing with COVID-19," said Molly Barackman-Eder, NeighborWorks' senior manager for financial capability. "It can take people months or years to recover from a financial crisis, making them more vulnerable when other emergencies arise and stalling their long-term financial goals. Financial coaches and counselors help people navigate resources and set them up for a faster recovery to get them back on track."

Counselors can create a customized plan to move from "just getting by" to making progress on long-term goals that might otherwise seem too overwhelming to take on alone, she adds.

The survey also addressed housing security and safety, finding that only half of Americans felt secure in their current housing situations. And while affordability was a top priority for Americans taking the survey, less than half said their homes felt affordable.

Ifill, addressing the importance of housing and housing affordability, said, "We have always believed that in order to create sustainable community, you need housing. I can feed you. I can educate you. I can protect you. But If I don't have a home, all of that is for naught."

Ifill added that where there are more homeowners than renters, there is a decline in crime. "And we also see an uptick in student scores, because what it creates is stability, and that's what is important to any community."

The survey, conducted by KRC Research, consists of a demographically represented base sample of adults (1,000) plus three oversamples (200 each) for Asian, Black, and Hispanic or Latino adults. Data are weighted to Census targets for region, gender, age, educational, race or ethnicity, household income, and employment.

07/17/2020