In 2019, Gloria Ortiz-Fisher, executive director of Westside Housing, was considering new ways to help clients. That's when she learned about a program helping residents establish credit by formally reporting on something they already did each month: Pay rent. Ortiz-Fisher studied the results of a pilot program between The National Association for Latino Community Asset Builders and the Credit Builders Alliance where credit scores increased by an average of 31-45 points. She thought a rent-reporting program could work for her NeighborWorks network organization as well.

"Our 183 tenants are all paying rent in some way or fashion," she says. "And everyone knows it's easier to establish credit than it is to fix bad credit. Many of our tenants hadn't even taken the time to figure out their score."

Established credit is necessary for getting a good loan rate and often, for taking out a loan in the first place. Ortiz-Fisher wanted residents to establish credit that could help them in the future. Westside Housing partnered with Esusu, a company that creates tools meant to dismantle barriers to housing, for the program. The first year they tried it, 43 Westside residents participated and 89% improved their credit scores. Forty one percent moved out of the "poor" tier. The average credit score increased by 63 points, to 662.

"There were 13 who had never had credit, so they established credit," Ortiz-Fisher says. "I have a single mom with two children who went from 0 to 684 in six months. If she wanted to, she would be able to get a loan from any bank."

For 2020, the second year of the program, the average score went up 70 points. "If you established that you were struggling due to COVID, you didn't get dinged, so it was still a plus and not a minus," she says.

A need to build credit

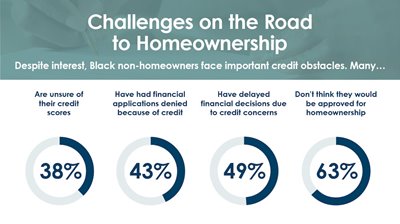

According to the NeighborWorks America Housing and Financial Capability Survey, credit is a challenge for American households, many of which have had financial applications denied or have delayed financial decisions due to credit concerns. This proved especially true for younger, lower-income and non-homeowning households.

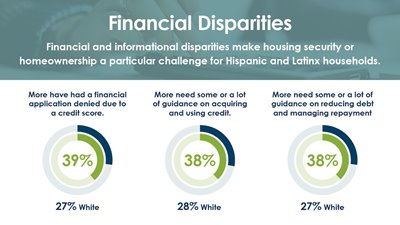

Black, Hispanic and Latinx adults reported persistent disparities in financial resources. While 66% of U.S. adults use credit cards, 51% of Black adults reported having a credit card, and 63% of Hispanic or Latinx adults reported having a credit card. At the same time, Americans say they need guidance on building credit and reducing debt.

Westside Housing is providing that guidance through financial coaching, and now, through rent-reporting. The NeighborWorks nonprofit is sharing information they've received so far with Community Housing of Wyandotte County (CHWC), a NeighborWorks network organization in Kansas City, Kansas. CHWC plans to embark on the rent-reporting program, too, part of a unique partnership the two Kansas City organizations – on either side of the Missouri-Kansas state line – share.

"If I can give rental customers a leg up in building credit worthiness to get ready for homeownership, it's worth it," says Brennan Crawford, CEO of CHWC. "It was a really easy decision to make." CHWC plans to offer rent reporting beginning in late fall or early winter. By then, he says, they will have utilized most of the rental assistance programs they have available to help residents who are behind on rent catch up.

Meanwhile, CHWC and Westside have partnered in hiring a third organization to help clients with credit building and home ownership empowerment services. "It's all part of a broader effort," Crawford says – an effort to help residents increase their credit-building capacity, and an effort for the two NeighborWorks organizations to help each other build capacity and efficiency by teaming up instead of duplicating efforts.

Ortiz-Fisher says that as the pandemic ends, more people will need to rebuild their credit. She expects the rent-reporting program to expand in the next year. Some tenants want to build credit to borrow money for school. "One wanted to buy a car. Whatever you want to build credit for is what we want to help them do. The fast pace and the incredible jump is what impressed me."

Finding a strategy

Talia Kahn-Kravis, innovations and CDFI manager at CBA, has found rent reporting to be a low-risk way to build credit. "We're excited about it as a credit-building strategy," she says. "We see it as a really key strategy to help renters get on the map and establish credit scores or build credit scores without having to take on debt."

CBA first began offering technical assistance to housing nonprofits who wanted to explore rent reporting nine years ago. In the time since, rent reporting has become more standardized, though it needs to become more so, Kahn-Kravis adds. Even so, "it's functional now and there are millions of renters who have their rent reported every month. It's making a difference on credit reports and scores."

In 2013, CBA did a study to show how rent reporting impacted scores and found that those who started with no credit score rose to prime or near-prime levels. Those with subprime scores went up an average of 32 points. A report from U.S. Department of Housing and Urban Development projected benefits for many individuals in public housing, where one half to two thirds of those with credit scores are rated as "subprime."

Ortiz-Fisher's own reporting points to projected benefits, as well. "If I can help families in need, especially people of color – anyone who is a tenant – that's great," Ortiz-Fisher says. "These residents are already paying rent and they already trust us. This way, we are able to take the next step to work on credit."

09/07/2021