When Harold Nassau first joined NeighborWorks America in 2000, the focus was more on single-family housing than on building the apartments people would come to call home. But very soon, multifamily housing became more central to the NeighborWorks network. So did caring for, assessing and developing those properties.

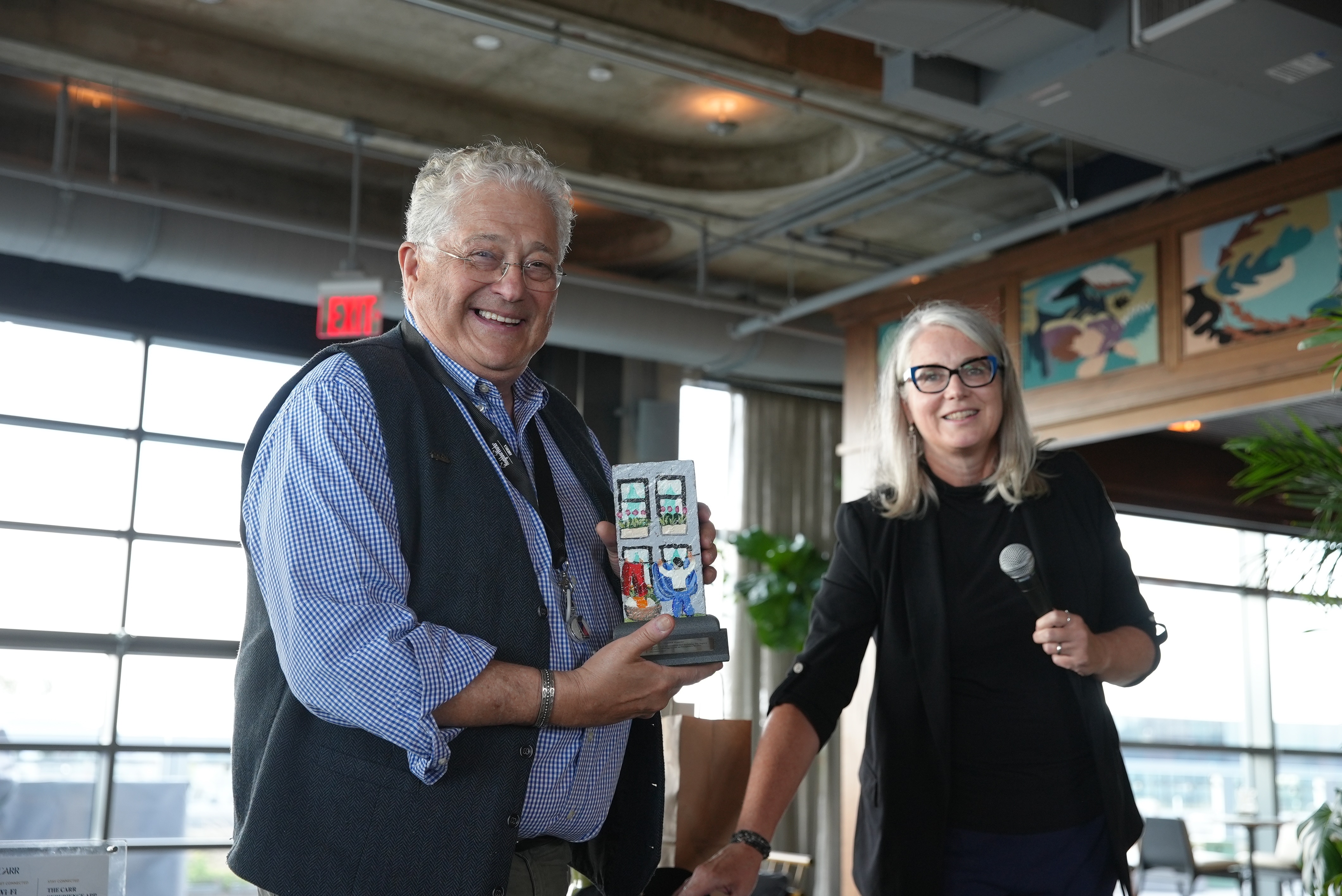

Now, retiring in October after 23 years with NeighborWorks, he says, "We have created the profession of the nonprofit asset manager."

At his core, says Lisa Getter, vice president for National Real Estate Programs, Nassau is a teacher. "I think of him as 'the professor.' He lives the work and the industry. He has a perspective far beyond NeighborWorks and his reputation comes from decades in this business and decades of respect."

"I love to teach," laughs Nassau. So as he leaves his post — but looks to the future of the industry — here is one of his lessons. He starts with the definition of asset management. Simply put: It's implementing the owner's goals. "In the for-profit world, the goals are a return on investment and value of the real estate. But in our world, you have to look at asset value and also performance, compliance and mission. The big difference is the mission piece." Nonprofits have a double bottom line, he says. "It's a real challenge."

When Nassau and Francie Ferguson, also retired, began the Multifamily Housing Initiative at

In the beginning, no one thought these properties would make money or have value, Nassau says. Everyone thought it was a way to provide a resource to the investment world and housing to low-income families. "But gradually, people learned that we were changing neighborhoods. We were improving housing. And many of the deals had real estate value."

Part of Nassau's legacy was to bring about, with Ferguson, a data system for portfolios and properties. NeighborWorks also provided technical assistance to improve the underwriting of real estate deals and to strengthen portfolios, helping nonprofits on both ends.

Ferguson, who worked side by side with Nassau for two decades, says he "brought a deeply principled vision of asset management that was simultaneously grounded in the rigorous financial and managerial realities demanded by the investor capital that drives the development and ownership of these properties." Managing the properties was essential to the lives of the residents, neighborhoods and organizations, she adds.

"The NeighborWorks network grew up" to incorporate multifamily housing, Nassau shares, with NeighborWorks passing along funds that would cover 7% to 10% of a deal, enough to mitigate some of the risk for owners. NeighborWorks also began chartering more organizations with a greater capacity for a multifamily line of business.

Over the years, Nassau says, the grants have lessened. But on the asset management side, NeighborWorks' ability to provide data, information and tools has increased. The importance of CHAM, the training vehicle for the network, also grew. NeighborWorks now provides a professional certificate in asset management and has more than two dozen courses under that umbrella.

The data that NeighborWorks collects has grown in importance, too, covering points ranging from building and unit type to turnover rates and average days vacant. "When you look at the numbers you can tell an awful lot about how a property is performing," Nassau says. "You can tell a lot about how successful they are and where to start looking for the problems." The data, he says, "isn't exactly a "CAT scan. But it is a darn good thermometer!"

The NeighborWorks Portfolio Strengthening Clinic is another part of Nassau's legacy. "My baby!" he says when it comes up in conversation (not to be confused with the grandchildren he'll spend more time with during retirement).

Nassau explains the impetus for the program: "In our world, portfolios are built not strategically; they are acquired one building at a time, opportunistically." A mayor offers a property on one side of town. The county assists with a property on the other. And sometimes, Nassau says, "there are dogs in the deal." When organizations needed help with both acquisition and management, the clinic provided that help. "We identified problems and opportunities," Nassau says.

NeighborWorks also set aside $100,000 a year for three years to help organizations in the clinic. Five or six network organizations take part each year, each with at least three representatives, including a senior staff member and board member. They worked together with experts, including Nassau, to analyze their portfolios, identify problems and strategize ways to attack those problems.

Sometimes, it means adding properties. Sometimes, it means selling them. Nassau remembers one clinic where a network organization's property had been losing dollar after dollar. "The executive director said, 'There are better owners for these properties.' And the board chairman said, 'No. These were our founding properties. We can't give them up; it's who we are.' The executive director said, 'No. It's who we were.' There were tears all around the table. Everyone was in tears. It was a gut-wrenching moment. But it was the moment the light went on."

Ferguson also shares, "Harold's ability to focus on the financial impacts but also the resident impacts was profound. From Day 1 until now, he has held out that vision — within NeighborWorks, and beyond — through CHAM."

Adds Phil Hood, NeighborWorks' senior manager of National Real Estate Programs, "He knows asset management better than anybody." And he's always been willing to share that knowledge, Hood adds.

Nassau will stay connected to the industry after retirement by volunteering with local groups near his home in Cambridge, Massachusetts. He's already been asked to join the board of one NeighborWorks network nonprofit (it's unofficial, so he's not saying who) and hopes to join others. He also plans to do more writing and research in the field. And of course, there are the grandkids.

He shares two lessons learned, which he hopes NeighborWorks will consider as it grows. One, he says, is understanding that our real strength is in the network. The other, he says, is understanding that multifamily real estate is the biggest line of business for many network nonprofits.

"It is the future housing for an enormous number of Americans. It is the backbone of many communities, and we should put more emphasis there." The American dream is no longer just a homeowner behind a picket fence. Nor is simply safe, secure housing. "We're creating communities," he says. "And that means a greater commitment to multifamily."