Houston resident Alex Zelaya wanted to purchase a home and stop paying rent. But with rising real estate prices, he wasn't sure what he would be able to afford. He began working with a real estate agent, who told him about the NeighborhoodLIFT program, a collaboration between NeighborWorks America and Wells Fargo that provides down payment assistance and homebuyer education to qualified homebuyers.

Zelaya applied for the program and qualified for $15,000. He purchased his home in January with the help of Avenue, the NeighborWorks network organization administering the program in Houston.

Zelaya applied for the program and qualified for $15,000. He purchased his home in January with the help of Avenue, the NeighborWorks network organization administering the program in Houston.

"Homeownership gives me stability," Zelaya shares. "Now I know I'm secure, and my housing costs won't go up." He knows at some point he will need a new air conditioning system, "but that comes with the benefits of homeownership, and I can plan ahead for that expense."

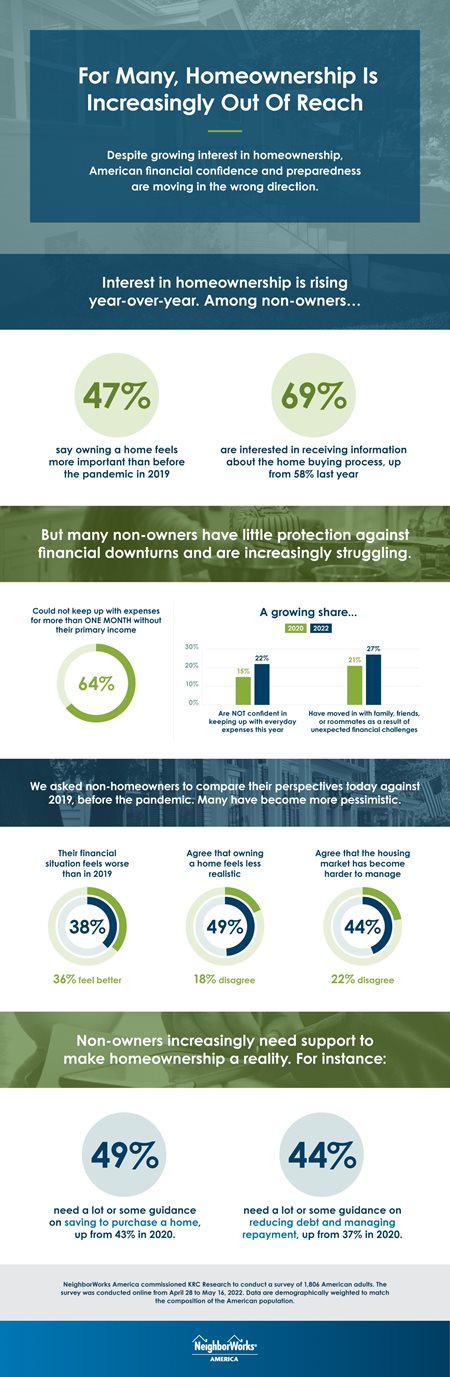

According to the 2022 NeighborWorks Housing and Financial Capability Survey, released in July, homeownership remains a priority for American households, with nine in 10 Americans agreeing that homeownership is important. But most non-homeowners – 76% – feel that they don't have the money for a down payment.

"Homeownership remains a priority for so many Americans, with affordability being the thing they look for first, as supported by the NeighborWorks Housing and Financial Capability Survey," says Lee Anne Adams, senior vice president, National Initiatives. "With more than three fourths of Americans saying they don't have the money to afford a down payment, we know this is a barrier we have to help break. Down payment programs address this issue head on. Our organizations also provide housing and financial counseling, including help with credit building and creating a budget – the steps that can lead to homeownership."

Other examples of down payment programs in the network include the Sam Smith "Hi Neighbor" Homeownership Fund in Seattle and programs in Minnesota and Arizona. NeighborWorks Western Vermont has a down payment assistance loan program, while Crawford Sebastian Community Development Council features programs that help with down payment assistance and closing costs.

NeighborhoodLIFT itself created about 25,000 new homeowners over 10 years, including Zelaya, whose yard has plenty of space for his dog, Simba. The 25-year-old IT professional works from home, and he is able to have a home office for the first time. He credits LIFT with making homeownership possible for him at a young age. "The news says young people will never be able to afford a home, but with LIFT, I was able to do it," he says. "It was a huge help."

Christian Greaser, director of lending for Avenue, says the funds help bridge the down payment gap. "By far the biggest barrier to families of color and low to middle-income homebuyers is the down payment," he shares. "A lot of folks come to us and their income is good, and their debt is good and their credit is good. But there's that down payment piece that gets in the way."

Greaser says down payment assistance often allows individuals to get better terms on their first mortgage due to the reduced loan-to-value. Because the $15,000 LIFT loans are forgivable after five years, the $15,000 becomes equity. "And that translates into long-term wealth."

Along with playing a crucial role as an intermediary between the funds and nonprofits, NeighborWorks helped with communication and technical support, Greaser says. "We're in our second round of LIFT funds in the last four years and we have grown by leaps and bounds in our ability to use customer management systems to administer the program efficiently. NeighborWorks is there at the beginning of the program to train and teach. And they also help build the systems. After we launch, NeighborWorks serves a crucial role in keeping tabs and helping when needed. They provide support in everything we do."

Houston Mayor Sylvester Turner says increasing affordable housing in Houston a priority. "There is an urgent need because as the cost of living increases, the American dream of homeownership is becoming less attainable, particularly for families who have not had the opportunity to attain generational wealth," he adds. "The NeighborhoodLIFT program helps close the funding gap for Houstonians on the cusp of homeownership because, as we know, every cent counts."

The most recent program launched in Houston in November 2021. Greaser expects to help a total of 300 new homeowners by the time it's complete.

08/04/2022