National Consumer Protection Week is a time for people to focus on finances and make sure they're making the right decisions to keep those finances healthy. But the things that lead us to make bad decisions or fall victim to credit problems or scams can happen all year round. And they can happen to everyone, regardless of income, ethnicity or education level, says Denise Murray, a community development specialist and expert on financial capability and financial literacy at the Office of the Comptroller of the Currency (OCC).

National Consumer Protection Week is a time for people to focus on finances and make sure they're making the right decisions to keep those finances healthy. But the things that lead us to make bad decisions or fall victim to credit problems or scams can happen all year round. And they can happen to everyone, regardless of income, ethnicity or education level, says Denise Murray, a community development specialist and expert on financial capability and financial literacy at the Office of the Comptroller of the Currency (OCC).

Murray says consumers are most vulnerable to scams when their emotions are in play — if a car breaks down and they can't get to work or take the kids to school, for example. If they're lonely. If they've had a bad day. "You don't make rational decisions when emotions are in play," she says. "Wherever you find a vulnerability, you'll find a scam."

Stress is often at the root of decisions that can harm finances, Murray says. That broken-down car can lead to a payday loan — short-term, high-interest loans that consumers sometimes use to get them to the next payday, but that can also start or continue a cycle of debt.

Things to watch for include everything from grandparent scams — when strangers lie that a grandchild is in jail to convince a grandparent to send money — to people purporting to be boyfriends, girlfriends and government agencies.

In the past few weeks, scams related to the COVID-19 virus, also known as the coronavirus, have been popping up, with people posing as healthcare officials and praying on panic. "There are people who sit back, take a situation and exploit it," Murray says.

In 2019, the Federal Trade Commission found millennials were 25 percent more likely to report losing money by fraud than people over 40. In addition to being more likely to report frauds, they're more likely to report that the fraud started via email.

Murray says that the difference might be that millennials are more open about reporting what happens to them. "Older victims are sometimes embarrassed. Sometimes they fear that people will think their mental capacity is starting to slip, so they don't report," she says.

People between ages 40 and 69 are more likely to report losing money via romance scams. And after a natural disaster, "you see home repair scams go off the charts. It really reaches all levels of society. No one is immune."

NeighborWorks America and many of its network organizations assist customers in building credit and financial capability. Murray offers these basic tips to help the network organizations help their consumers — and everyone else — protect their finances.

Be aware of your credit standing

Checking credit standing several times a year will help consumers make sure nothing is amiss. Visit annualcreditreport.com to get a free report from TransUnion, Equifax and Experian. Consumers are entitled to a free report from each of the three national reporting agencies once every 365 days, so Murray recommends spreading it out among them, one report every four months. "It will give them a base to know where they are. Is there an account they've closed that's still showing as open? Is there fraudulent activity?" Being aware of your credit situation provides a sense of calmness, she says. "If you have strong credit, you're in a position of strength for talking to lenders if you're making a big purchase." And if you have bad credit, she says, "It gives you a road map on how to clean it up."

Checking credit standing several times a year will help consumers make sure nothing is amiss. Visit annualcreditreport.com to get a free report from TransUnion, Equifax and Experian. Consumers are entitled to a free report from each of the three national reporting agencies once every 365 days, so Murray recommends spreading it out among them, one report every four months. "It will give them a base to know where they are. Is there an account they've closed that's still showing as open? Is there fraudulent activity?" Being aware of your credit situation provides a sense of calmness, she says. "If you have strong credit, you're in a position of strength for talking to lenders if you're making a big purchase." And if you have bad credit, she says, "It gives you a road map on how to clean it up."

Get in the habit of saving

The last week in February was America Saves Week, and Murray points to a recent Federal Reserve survey that found that 40 percent of Americans couldn't cover a $400 expense. Saving $15 a week could make a big difference, she says. She recommends having a savings account that you can't access with an ATM card. That's what she does, she says. If it's more difficult to get to the money, it's easier to save it. "People also need to realize that paying down debt is a form of savings. Once you start saving, it really starts growing," she adds.

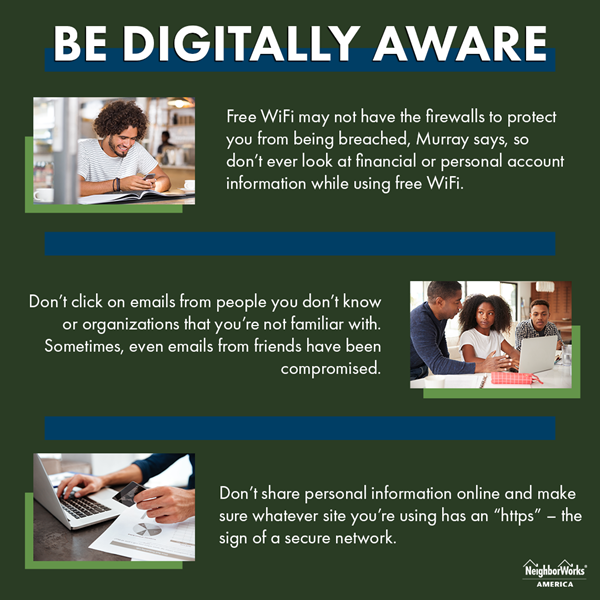

Be digitally aware

Because we spend so much of our lives online, Murray says there are a number of things to watch out for.

- Free WiFi may not have the firewalls to protect you from being breached, Murray says, so don't ever look at financial or personal account information while using free WiFi.

- Don't click on emails from people you don't know or organizations that you're not familiar with. Sometimes, even emails from friends have been compromised. "Understand: The government is never going to email you and ask for money. If you get that kind of an email, step back and call the agency."

- Consumers tend to ignore bank and credit card statements when they receive them online. That's a mistake, Murray says. Often someone who has accessed your card will test it first with small purchases before making a big one.

- Don't share personal information online and make sure whatever site you're using has an "https" — the sign of a secure network.

If something sounds too good to be true, it's probably false

"Be wary of things that sound too good to be true," Murray says. "That's when you need to ask questions. The only stupid question is one that isn't asked."