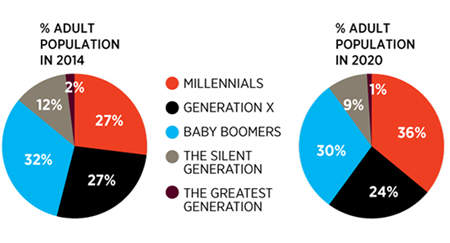

Millennials are one of the most researched and talked about demographics. Born between 1980 and 2000, they are the biggest generation in U.S. history—and these 92 million individuals have distinctive characteristics and priorities that continue to reshape the world in which we live. The Millennial Impact Project, which mines data from more than 25,000 participants, is one of the most comprehensive studies of the millennial generation and its involvement with causes. According to their lead researcher Derrick Feldmann, “Millennials will soon dominate our companies, organizations and communities.”

Are you “in sync” with the millennial wave in your community? It’s imperative we understand this immense cohort of 18- to 34-year-olds, who are reshaping our economy and our culture. Here are three traits that define them and what you need to know.

Trait 1: Tech-savvy way of life

Perhaps one of the most obvious characteristics—beyond a fondness for tattoos, colorfully died hair and body piercings—is that millennials are the first “digital natives,” individuals born after the widespread adoption of technology like the Internet and mobile devices. Simply put: They are supremely tech savvy – with 3 out of 4 not only owning a smartphone, but also skilled at using the plethora of apps to compare prices, check out peer reviews of products and stay socially connected.

Thus, it has become widely accepted that if you want to engage millennials, you must plug into the social media platforms they use. The most commonly used sources for news and information are Facebook, YouTube and Instagram, in that order—with Facebook still the leader by far. (Twitter is largely used to by this group to see what is “trending.”) However, despite the heavy use of social-networking platforms, it’s also important to remember that about a quarter of millennials have chosen to opt out of social media in what can almost be described as a backlash, based on the time consumed, privacy issues and a growing “uncool” factor for the older Facebook. In addition, there is so much competition for users’ attention, due to the sheer volume of items in their newsfeed and characteristics of the algorithms that govern Facebook and other channels, the chance of a brand’s posts being seen are said to be 12 percent or less.

The moral of the story? Diversify your communication!

Trait 2: Ownership shunned

Millennials have been reluctant to buy items like homes, cars, music and luxury goods. According to a Goldman Sachs report, millennials are instead turning to a services that provide access to products without the burden of ownership, giving rise to a "sharing economy." A recent Forbes article comments that this type of economy is growing fast —with nearly a quarter of the U.S. population engaging in some form of economic sharing like renting a spare bedroom via Airbnb, a neighbor’s car on RelayRides, a spare driveway on JustPark or a gently used prom dress on Rent the Runway.

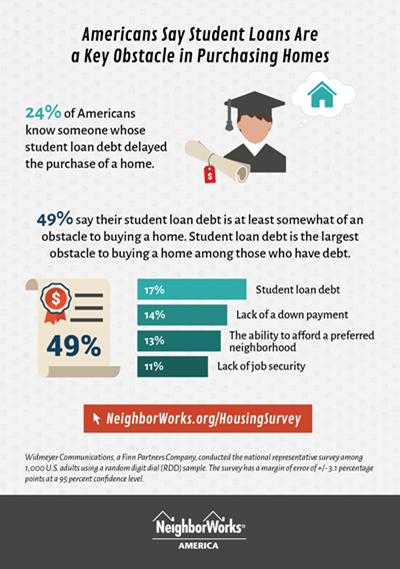

The great reluctance to purchase luxury products may be less about lifestyle and more about the economic realities facing millennials. Although millennials are the most educated generation in history, they have paid a price in the form of high college debt. In the latest Allstate/National Journal Heartland Monitor poll, nearly 3 in 10 young people who define themselves as just starting out cited paying off student loans as their biggest financial challenge.

The great reluctance to purchase luxury products may be less about lifestyle and more about the economic realities facing millennials. Although millennials are the most educated generation in history, they have paid a price in the form of high college debt. In the latest Allstate/National Journal Heartland Monitor poll, nearly 3 in 10 young people who define themselves as just starting out cited paying off student loans as their biggest financial challenge.

This is due in part to the fact that many millennials are on the prowl for a job. Despite the recent rosier unemployment figures, Anthony Carnevale, a director and research professor for Georgetown University’s Center on Education and the Workforce, writes that the millennial generation is still lagging in the workplace, making up 40 percent of the unemployed in the United States. To add insult to injury, millennials are generating far lower earnings compared to their parents.

The bottom line: Student debt and lower incomes mean millennials often are forced to delay making key life decisions –including buying a home.

The opportunity: They are desperately in need of financial counseling and coaching.

Trait 3: Still want the American Dream

Although millennials are slow to marry and purchase homes, as well as more committed to spending extra cash on their health and healthy foods, Goldman Sachs is banking on a shift as millennials age. It predicts: “As millennials enter their peak homebuying years (between ages 25 and 45), their reluctance to enter the housing market could change. The cohort’s sheer size, plus its desire to settle down in the future, could lead to a surge in home sales.”

Until then, many millennials are staying put. The Pew Research Center data show that more young adults are living with their parents and relatives than at any time since 1940. This stat is related to two consequences of the lingering Great Recession: lack of high-paying jobs and high student debt.

Yet, a number of housing industry leaders remain hopeful. A recent survey by Trulia found that millennials still consider homeownership a part of the American dream. Realtor.com’s chief economist, Johnathan Smoke, believes millennials will buy 1 out of 3 homes in 2016, a small uptick from last year. Even Zillow’s chief economist, Svenja Gudell, says the median age of first-time homebuyers will hit a new high in 2016. However, others are more skeptical.

In a recent Bloomberg article, “Reasons to Be Skeptical about a Millennial Home buying Boom in 2016,” Patrick Clark writes, “Homeownership is a better deal, but only for those millennials doing well enough to take advantage of it. The rest of the age group can look forward to rising rents.”

Whatever the scenario, millennials need help determining when homeowership is right for them, and how to plan and budget for it. And that’s where nonprofits are best positioned to help.